The company has developed a fraud prevention and risk management platform that protects payment processors and large online merchants from attacks.

UrbanFox, a Dublin-based anti-fraud technology company, has raised €3.5 million in funding, with the venture capital arm of JetBlue Airways among the investors.

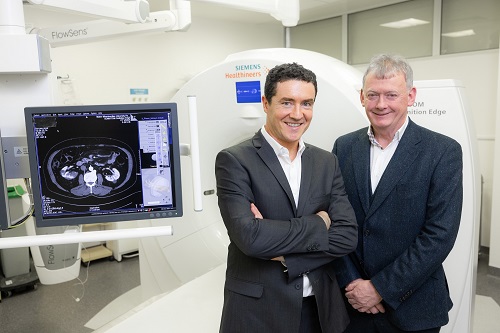

Founded in 2017 and led by Daniel Loftus, UrbanFox is behind a fraud prevention and risk management platform that protects payment processors and large online merchants from complex synthetic fraud attacks.

Synthetic identity fraud is a highly sophisticated and hard-to-spot form of online fraud in which aspects of an individual’s identity and behaviours are used to develop fake identities to purchase goods and services. The cost of synthetic identity fraud is estimated to be nearly $2.5 billion, with forecasts that it could easily double to $5 billion within the next two years.

UrbanFox’s technology uses machine learning to predict the actions of bad actors and stop them before they can commit criminal acts.

“Over the last five years, the rate at which fraud has grown has continued to increase. It is affecting more retailers and more customers than ever before. Fraudsters are getting smarter. They are better funded and far more sophisticated than in years past. Current fraud detection solutions are no longer up to the task,” Loftus said.

“UrbanFox is built to more accurately identify the most sophisticated type of fraud attacks and stop fraudsters before they ever get close to using a compromised credit card.”

JetBlue Ventures co-led the funding round for UrbanFox with MiddleGame Ventures, which last month announced a new €40 million fintech-focused fund backed by Enterprise Ireland to support promising start-ups.

Other participants included Furthr VC, IAG Capital Partners, Forward VC, WxNW and Twilightford, along with a number of US and Irish-based angels.

Loftus said UrbanFox plans to use the capital to grow its team and reach more customers in the travel and retail sectors.