Irish finance fintech NoFrixion has been granted Electronic Money Institution (EMI) authorisation by the Central Bank – a significant milestone for the company.

The company, which was set up in 2021, is pioneering embedded finance across the EU, combining the power of its MoneyMoov platform, with the regulatory approval to deploy it.

The company became part of the Furthr VC portfolio after participating in its October 2022 funding round.

Earlier this year, the company was also granted Virtual Asset Service Provider (VASP) registration by the Central Bank.

NoFrixion said it is the first Irish fintech to secure this coveted regulatory status and it positions the company to meet the burgeoning demand for MoneyMoov.

NoFrixion has gone from a startup to scale-up in less than 24 months, while it has also raised almost €5m in venture capital funding.

It was also recognised as the Digital Banking Platform of the Year at the recent National Fintech Awards in Ireland.

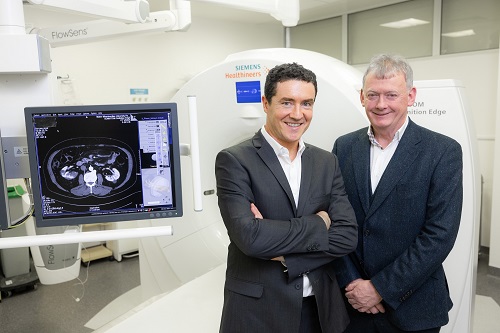

Feargal Brady, NoFrixion’s Chief Executive, said that many businesses struggle to identify payments, let alone reconcile them and millions of hours a year are wasted, searching through archaic internet banking services, trying to work out who paid what.

“MoneyMoov just removes that problem completely – it’s gone, it’s over. Obtaining this authorisation from the Central Bank of Ireland is a testament to the incredible team here at NoFrixion. It enables us to get on with the digital transformation of money movement and reconciliation,” Mr Brady said.

He said that Ireland is developing a fantastic Fintech ecosystem – adding that all the ingredients are here for success.

“Great talent, outstanding entrepreneurs, and support from the Department of Finance, Enterprise Ireland, the Central Bank Innovation Hub, Fintech Ireland and more – we are really excited about this next phase of growth,” he added.