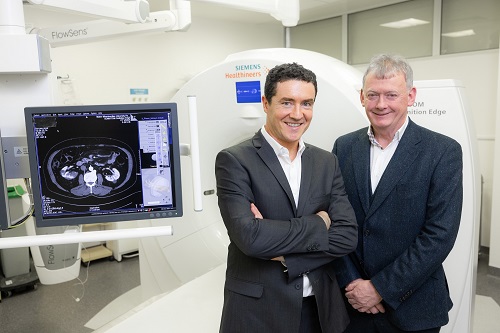

Furthr VC managing partner Richard Watson talks about the challenges and opportunities facing entrepreneurs’ venture capital in Ireland.

Richard Watson leads Furthr VC, one of the most active early-stage VC investors in Ireland.

He has worked in venture capital for more than 15 years and, before this, spent almost a decade in the medical device and semiconductor industries in Sweden, Ireland and the US.

“People think venture capitalists are the guys or girls handing over the money. But actually, people don’t realise just how intrinsic those relationships become. You are part of the team, you are in the trenches with these guys and you’re whipping them into shape while they’re trying to be innovative”

As Managing Partner at Furthr VC, he has extensive experience investing in, advising and scaling tech and life sciences companies in Ireland and the UK.

Furthr VC invests in tech companies at the seed and early stages. Born as the venture arm of Dublin BIC (Furthr), it launched its latest early-stage venture fund in late 2019 with the backing of leading Irish technology entrepreneurs and business leaders, as well as Enterprise Ireland.

This fund is highly active, backing seed to Series A B2B software and MedTech in Ireland, with initial investments of up to €650,000. Recent standout investments include Klearcom and Ronspot.

Furthr VC says it doesn’t just cut cheques, instead, they join forces with bold start-up teams shaping tomorrow’s Irish tech leaders.

The road less travelled

Speaking with the ThinkBusiness Podcast, Watson said that his background has been in engineering. “I studied biomedical and electronics at Trinity and I’ve always had an interest in engineering, particularly in tech and medicine. I started out doing electronic engineering and then researched biomedical engineering.”

From university, Watson went straight into the world of start-ups, initially in Sweden where he worked in the MedTech space. “I was part of the tech team developing a device for sleep apnoea diagnostics in your own home. That was a great journey. It was a typical start-up and I worked as a developer as well as business development and operations. When the business was acquired the culture changed and so I went to work for another start-up in Stockholm that was focused on the drug delivery side of MedTech.”

Watson views his experience in Sweden as foundational for his career as an engineer and later as an investor. On his return to Ireland, he joined Intel in Leixlip, which he describes as something of a culture shock. “In a start-up, it is quite an exciting ride, like being on a speedboat going over waves. But in a big multinational you feel the difference you make is only marginal. I had a great time at Intel but I kind of knew I wanted to get back to the start-up world again.”

But instead of returning to work in a start-up, Watson decided to return via the venture capital route. And just like with the start-ups and multinational worlds, he had to embrace a steep learning curve.

“People think venture capitalists are the guys or girls handing over the money. But actually, people don’t realise just how intrinsic those relationships become. You are part of the team, you are in the trenches with these guys and you’re whipping them into shape while they’re trying to be innovative. You have to be careful not to dilute that magic that you invested in the first place or tamper with that. It’s not just the money, but how involved a venture capitalist actually gets.”

Watson explains that a lot of the time spent by venture capitalists is actually spent on getting to know founders before they invest. “The chemistry has got to be right from the start because you’re going on a long journey. It typically begins at seed stage but if there isn’t an early exit, it’s going to be a long enough journey of usually several years. For us, it is really important that we get on with the team and that there’s real alignment there. We don’t want to come in and interfere or change what they’re doing. We’re there to help with strategic advice to help when it comes to building the team, formulating new strategic initiatives and so on.”

For Watson, the people actually outweigh the technology. “It’s the people, then the market, then the tech. Every founder is different. You have some who are a bit quirky and you’ve got to be able to get along with them. The chemistry may not be 100% perfect but it’s got to be pretty good. And you’ve got to be able to understand each other. There’s got to be an openness and trust. Having alignment and a mutually trusting relationship with the people you are backing is really important.

“Of course, we look at the other elements of the business, but the most amount of time is getting to know the people.”

Across the world venture capital funding is being pummelled by market conditions and in Ireland, seed funding is still an acute issue.

Watson believes more should and could be done to interest the pension funds here in Ireland in supporting venture capital funds and in turn investing in entrepreneurial Irish businesses. The move to auto-enrolment, he urges, offers a major opportunity.

“The Government and Enterprise Ireland have been hugely supportive of the Irish start-up community; I couldn’t give them enough praise. But we need to see other sources of capital coming in to invest in funds too. It would be great to see if this potential pot of money could come through the overall pension funds.”

While the availability of venture capital is crucial, Watson argues that beyond money the challenge for tech firms is building high-performance teams and that is not easy in an environment of full employment or where talented executives and engineers can access higher salaries in multinationals.

“It’s harder to jump into the start-up world or to live on your savings when everyone around you is living good lifestyles on decent salaries. It’s quite hard.”

More capital needed

“We are seeing a lot of really strong innovation in terms of MedTech, life sciences, augmented reality, machine learning, internet of things, cybersecurity and a range of R&D intensive areas”

Another danger on the horizon that many don’t foresee but Watson is keenly aware of is the enormous interest in Irish start-ups from overseas venture capital players as these firms go from early-stage to later-stage investments.

“We definitely need more capital at a seed stage here but as these companies go from growth to later-stage we’re seeing a lot of the bigger, larger venture capital funds coming here, which is great because they are investing in fast-gaining Irish companies. But then again, we’re also seeing a lot of companies at a certain stage removing their centre of gravity to the US because they need to go there to tap into those sources of confidence.”

Watson said it would be a shame to lose growing Irish companies to the US because that’s where the capital is. “And that is what unfortunately happens. It’s good for investors in terms of getting a return, but it’s not good for Irish jobs.”

That said, Watson believes Ireland has cemented its position as a tech leader in Europe.

“We are on the map now for international investors and we are one of the leading research and development and innovation locations around the world thanks to Science Foundation Ireland and Enterprise Ireland.”

“We are seeing a lot of really strong innovation in terms of MedTech, life sciences, augmented reality, machine learning, internet of things, cybersecurity and a range of R&D intensive areas.”

“I think we should be proud that there is a really large focus on trying to help more spin-out companies get off the ground and scale. There’s a lot of good stuff coming through the universities at the moment.”